C-corporation income tax returns (IRS Form 1120):

Extended: July 15, 2020

Tax Filing

We prepare personal tax returns, sales tax returns, payroll returns, corporate returns and help maintain compliance. We often work with the following kinds of returns:

- Personal / individual

- Corporate

- Partnership

- Trust

- Not for profit

- Gift tax returns

- Sales & use tax returns

- Payroll returns

- More as required

Tax Planning

Tax planning focuses on saving you from surprises at the end of year, and can mean you get to keep more of what you make. Our professional tax planning services are also extremely valuable for those who are anticipating or going through a major life event or change.

- Income tax planning

- Entity planning

- College planning

- Home buying

- Inheritance planning

- Personal tax planning (marital consulting)

- We’ve made all the mistakes before so you don’t have to!

Our Team:

•Real people, real answers, no guesswork!

• In business for over 10 years

• Tax planning & business structure pros –

keep more of what you make!

• Local professionals – stop by or call us today!

Experts in:

• Sales, payroll, corporate, and other tax filing requirements & management

• Cloud-based collaboration available for easy money management

• Advice you can trust, from professionals who have your back

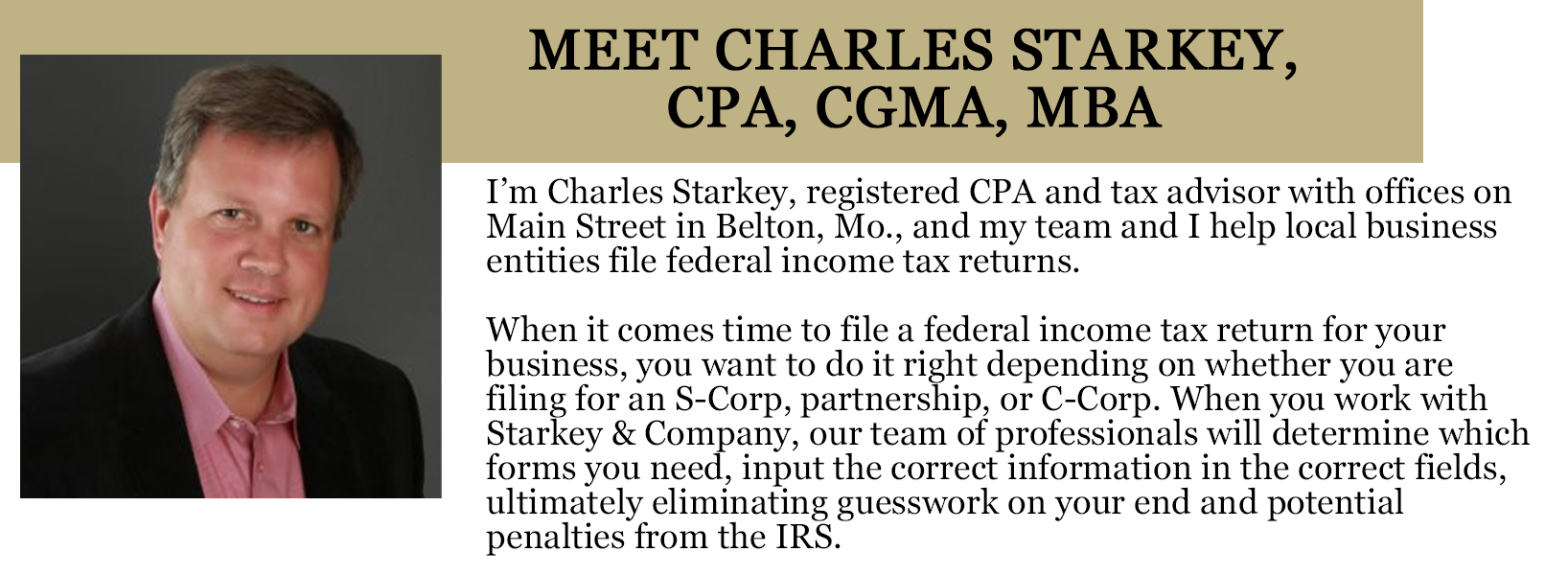

Contact us today & let us handle your corporate/partnership tax return properly.